MG Motor India No 1 In Customer Service, Sales Satisfaction

[ad_1]

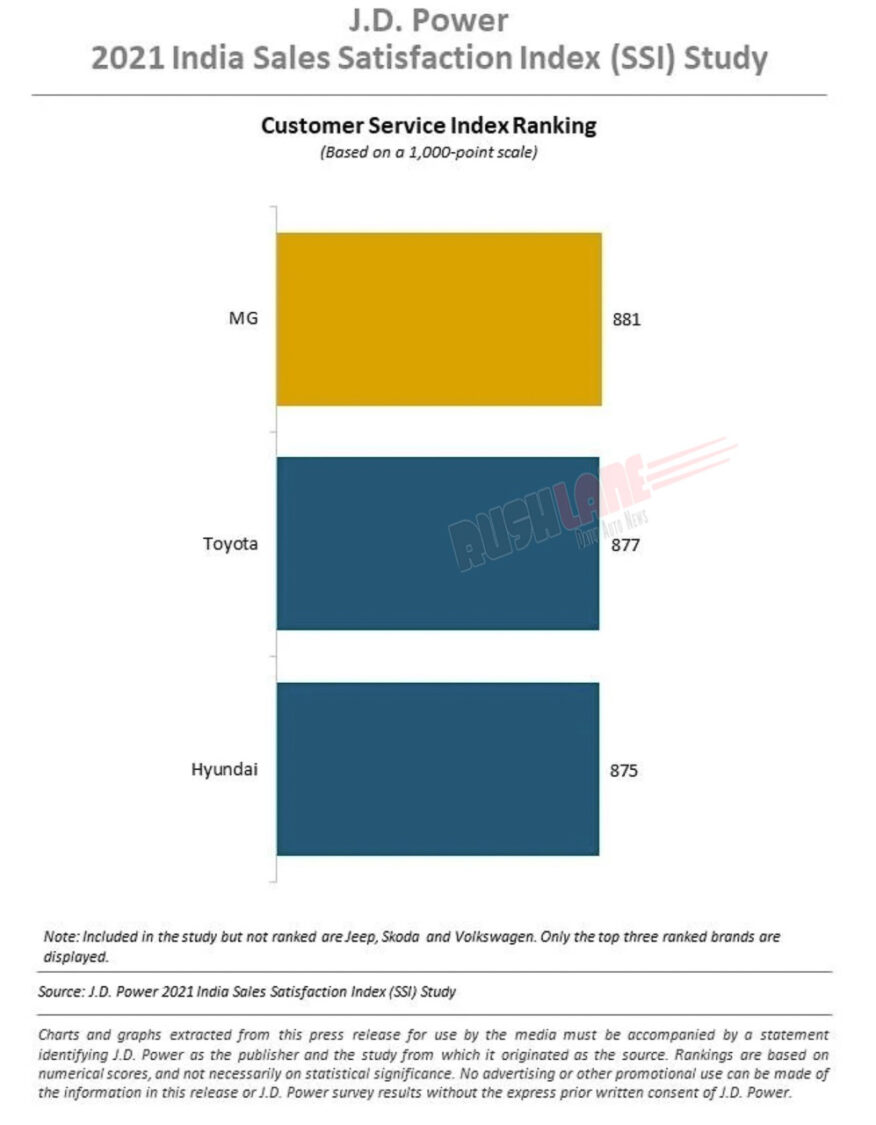

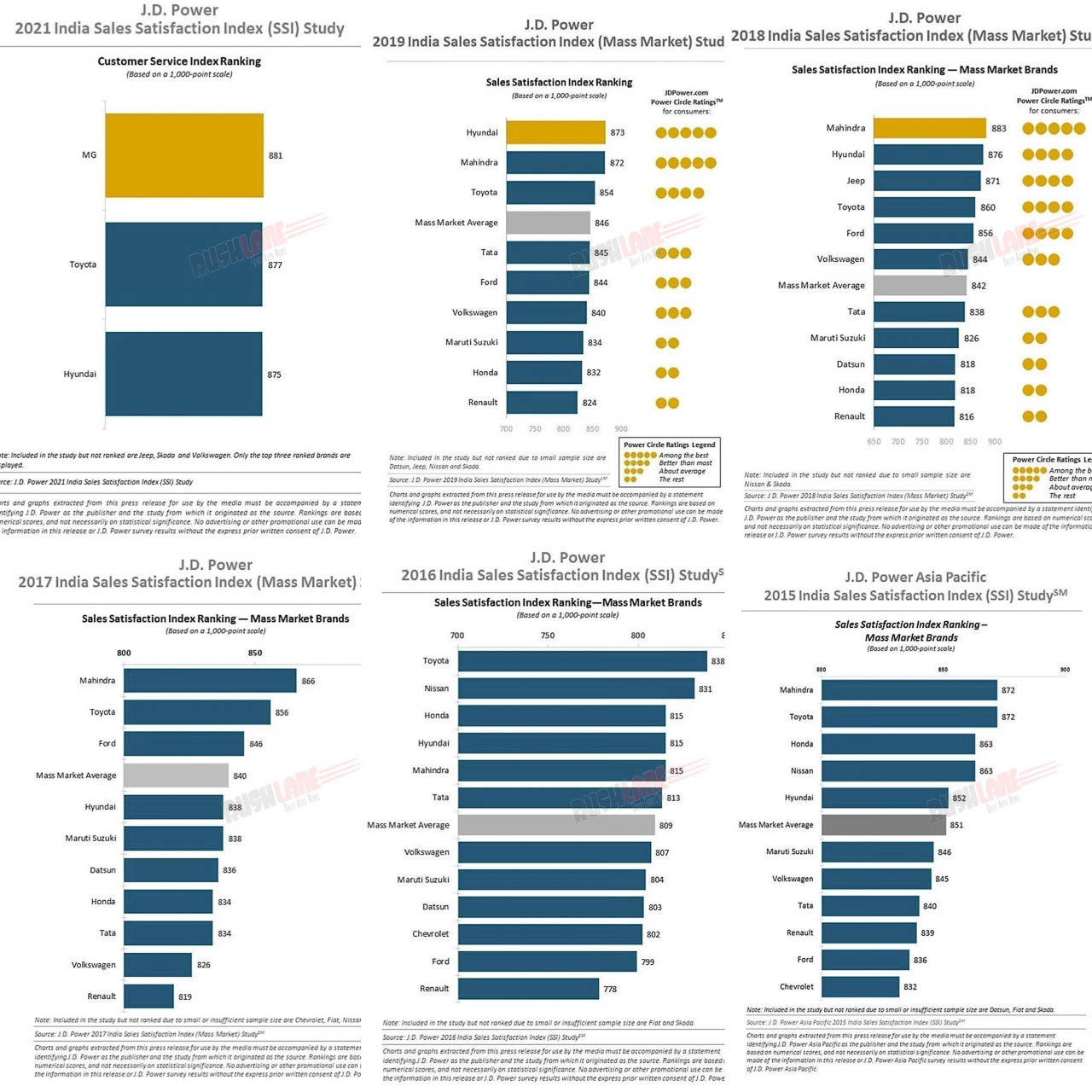

J.D. Power 2021 India Sales Satisfaction Study (SSI) ranks MG Motor highest with a score of 881

The digital push to almost every aspect of modern living has been multi-level. An age of active digitalization sees upward of 85 percent of shoppers conducting online vehicle research. But this doesn’t undermine a strong preference for physical visits to showrooms for a vehicle purchase.

This as per J.D. Power 2021 India Sales Satisfaction Study (SSI) released today in collaboration with NielsenIQ. The study examines sales satisfaction in the mass market segment.

India Sales Satisfaction 2021 – J D Power

MG Motor India ranks highest with a score of 881 (on a 1,000-point scale). Next on is Toyota (877), and Hyundai India (875). 2021 India Sales Satisfaction Study (SSI) is based on responses from 5,593 new-vehicle owners.

Purchases are dated from January through December 2021. April-June 2021 were not considered basis severe Covid-19 pandemic situation in India. The study was fielded from September through December 2021.

2021 India Sales Satisfaction Study (SSI) measures new-vehicle owners’ satisfaction with the sales process. This is done by examining satisfaction on six factors (listed in order of importance) – delivery process (20%); dealer facility (18%); paperwork completion (17%); working out the deal (15%); sales consultant (15%); and brand website (14%).

Youtube and search engines

Online search is rife, whatever the product be. This is true even for the smallest household product, so when it is a big item like a car, online searches are almost inevitable, and long term. As per the study, which has returned after a gap, online information search is a key activity in the vehicle purchase journey.

48 percent of survey respondents watched YouTube videos or used search engines when gathering info. 35 percent of folks reviewed social media advertisements as an online information source. Traditional offline sources like peer recommendation and test driving a vehicle continue to be strong info sources in the vehicle selection process.

Other key findings of the 2021 study are – Shoppers expect a prompt response to an online request to be contacted. At present, dealerships take an average of seven days to respond. Customer expectation averages five days. 11 percent of shoppers said that they did not hear from their dealer following an online request.

Shoppers say their complete purchase journey is 51 days. The first 20 days are spent gathering info online. 31 days are spent in dealer interaction. When choosing a dealer, recommendation from peers or family (61%) leads. This is followed by dealership location (54%), and immediate delivery (49%).

Return to dealerships

While online searches are part and parcel of daily life, 68 percent of respondents look forward to stepping into a showroom for their next vehicle purchase. This group wants to experience the entire journey in-person. 20 percent said they would want a complete online experience.

“The critical issue to address here is the divergence of the preference,” said Sandeep Pande, lead of the automotive practice India at NielsenIQ. “Essentially, customers are thinking at two levels. Firstly, the readiness of the dealers to seamlessly transition from one mode to another and, secondly, the robustness of the technology integration to handle high-value purchases.”

[ad_2]

Source link