India’s Festive Season Spending Hits Record High

India’s Festive | $74 Billion Boom Sets Stage for Strong FY26

💰 Record-Breaking Festivities: The Data Story

This festive season (Navratri to Diwali 2025), Indian consumers fueled an unprecedented spending spree, propelling the economy to new highs.

| Key Metric | 2025 Festive Season Data | Year-on-Year Growth (YoY) |

| Total Retail Trade Turnover | $\approx \text{Rs. } 6.05 \text{ Lakh Crore}$ ($\approx \$74 \text{ Billion}$) | +25% over 2024 |

| E-commerce Sales (GMV) | $\text{Rs. } 1.24 \text{ Lakh Crore}$ | +31% (Strong rebound from 2024) |

| Auto Registrations (PV & 2W) | High-ticket item bookings surged | +20-23% in first 32 days of season |

| Credit Card Spending | 42% of cardholders spent over $\text{Rs. } 50,000$ | Indicative of high-value purchases |

📊 Category Highlights: Sales were driven by Consumer Electronics (+35-43% YoY GMV), Gold & Jewellery ($\approx \text{Rs. } 20,000 \text{ Crore}$ on Dhanteras), and apparel.

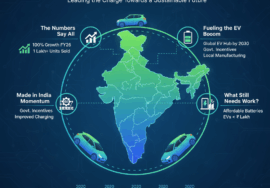

📈 What’s Driving the Boom

The consumption surge is structural, supported by key economic levers:

- Soaring Confidence: The RBI’s Consumer Confidence – Current Situation Index (CSI) rose to $\approx 96.9$ points (as of Sep 2025), reflecting a positive perception of current income and the overall economic situation.

- Tax Relief & Liquidity: Reduced GST rates (GST 2.0) on categories like apparel, consumer durables, and daily-use items, coupled with direct income tax exemptions, put more disposable income in the hands of the middle class.

- Digital & Tier-II/III Power: The “Quick Commerce” wave accounted for $\approx \mathbf{12\%}$ of total festive e-commerce GMV. Crucially, rural and semi-urban areas contributed nearly $\mathbf{28\%}$ of total retail sales, indicating broad-based demand.

- Vocal for Local: Consumer preference for Indian-made goods was strong, with $\mathbf{87\%}$ of consumers choosing domestic products, leading to a noticeable decline in demand for Chinese imports.

🛍️ The Ripple Effect: Fueling FY26 Growth

The festive momentum has created a robust foundation for the next fiscal year:

- Strong GDP Outlook: The government’s consumption-led growth is aligning with top forecasts. The IMF and RBI project India’s GDP to grow at $\mathbf{6.6\% \text{ to } 6.8\%}$ in FY26, making it one of the world’s fastest-growing major economies.

- Job Creation: The services sector (logistics, travel, packaging) contributed over $\text{Rs. } 650 \text{ Billion}$ and generated 5 million temporary jobs during the season, providing immediate income support.

💡 Insight by Businesstantra:

India’s spending story isn’t about extravagance — it’s about accelerated economic confidence returning in full swing. The high-velocity, broad-based consumption signals that the benefits of policy reforms and a moderating inflation outlook are translating directly into increased purchasing power, providing a significant consumption multiplier effect for a strong FY26.