XAU/USD remains on the defensive amid faster Fed hike views

[ad_1]

- A combination of diverging forces failed to provide any impetus to gold on Tuesday.

- The Fed’s hawkish outlook, sustained USD buying continued acting as a headwind.

- The Ukraine crisis, growth/inflation concerns helped limit the downside for the metal.

Gold witnessed subdued/range-bound price action on Tuesday and remained confined in a narrow trading band, below the $1,980 level through the first half of the European session. Growing market acceptance that the Fed would tighten its monetary policy at a faster pace to curb soaring inflation acted as a headwind for the non-yielding yellow metal. Apart from this, the unstoppable rally in the USD/JPY pair is bolstering the US dollar bid at the expense of the dollar-denominated commodity.

The downside, however, remains cushioned amid the retreat in the US Treasury yields from the multi-year highs. Apart from this, a generally weaker tone around the equity markets was seen as another factor that extended some support to the safe-haven gold. The COVID-19 lockdowns in China, a protracted Russia-Ukraine war, along with a potential European Union (EU) embargo on Russian gas have intensified inflation and growth concerns. This was seen as another factor that benefitted the metal’s appeal as a hedge against rising costs. That said, the sentiment will be driven by the Fed’s expectations amid absent relevant market moving economic releases from the US.

Also read: Gold Price Forecast: $1,961 could emerge as key support for XAUUSD amid firmer USD

All eyes on the Fed and US dollar

More hawkish comments from Federal Reserve officials have reinforced expectations for faster US policy tightening. They started to flow in from New York Fed President John Williams who said last week that a half-point rate rise next month was “a very reasonable option,” in a further sign that even more cautious policymakers are on board with faster monetary tightening.

Meanwhile, Fed member James Bullard spoke on Monday and offered further insight on the outlook for Fed policy. Bullard is one of the bank’s most hawkish and has called for interest rates to reach 3.0% this year.

US inflation is “far too high,” he said on Monday, repeating his case for increasing interest rates to 3.5% by the end of the year to rein in inflation expectations and slow what are now 40-year-high inflation readings.

“What we need to do right now is get expeditiously to neutral and then go from there,” Bullard said at a virtual event held by the Council on Foreign Relations, adding that he doesn’t expect to need to raise rates by more than half a percentage point at any meeting.

He said that the Unemployment Rate can continue to fall even with aggressive rate hikes, repeating his view that unemployment, now at 3.6%, will go below 3% this year.

This all comes ahead of the Fed Chair Jerome Powell later this week, where he is expected to solidify expectations for a 50 bps rate hike at the coming Fed policy meeting.

As a consequence of such sentiment, the US rate futures market has priced in a 96% chance of a 50 basis-point tightening at next month’s Fed policy meeting, and about 215 basis points in cumulative rate increases in 2022, providing ample support for the dollar.

As for positioning, speculators’ net long bets on the US dollar fell for a second straight week, according to calculations by Reuters and US Commodity Futures Trading Commission data released on Friday. The value of the net long dollar position was $13.22 billion for the week ended April 12.

Gold technical analysis

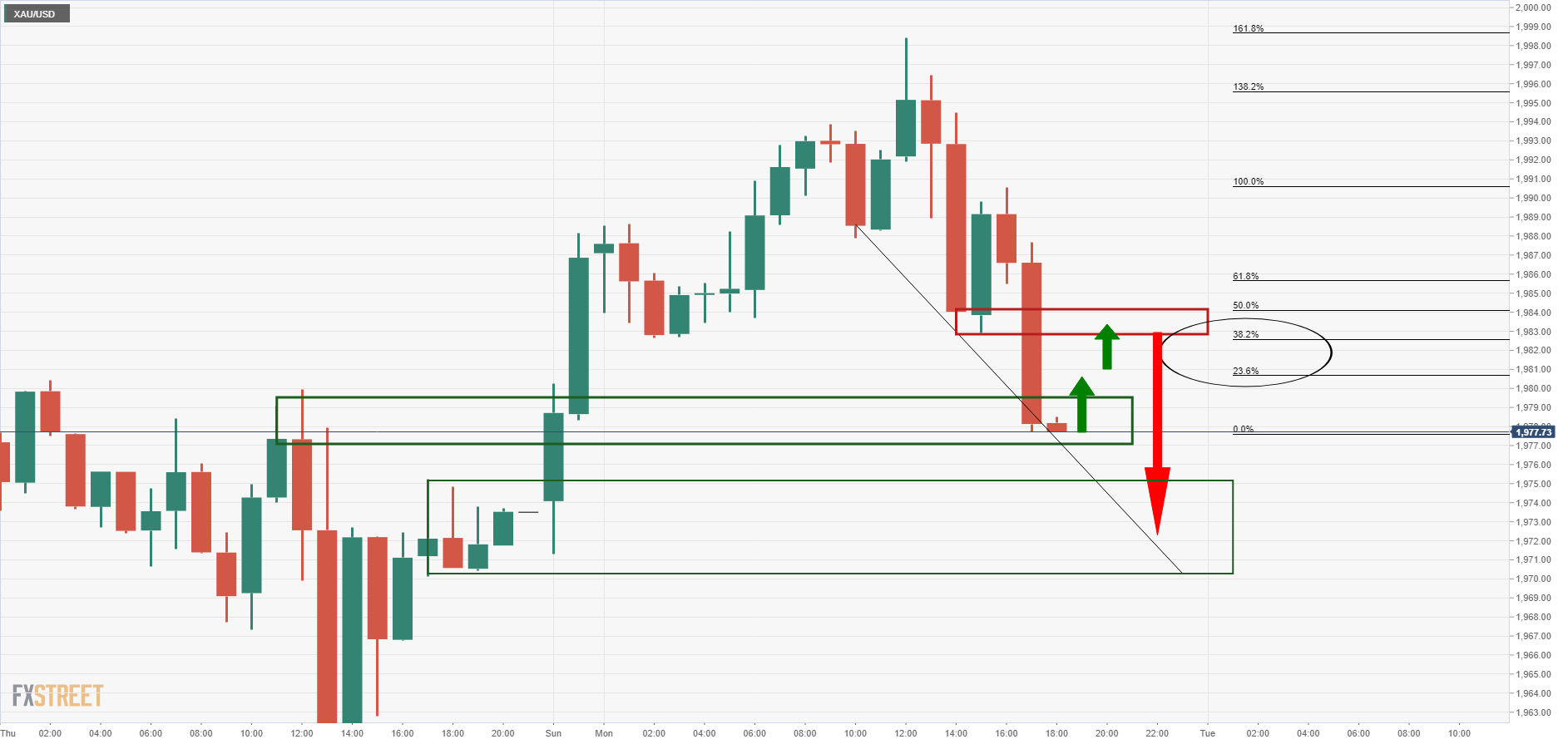

The price had moved in on a firm area of hourly support:

The price was expected to reset the prior lows as resistance and then mitigate the remainder of the price imbalance below targeting the $1,970s.

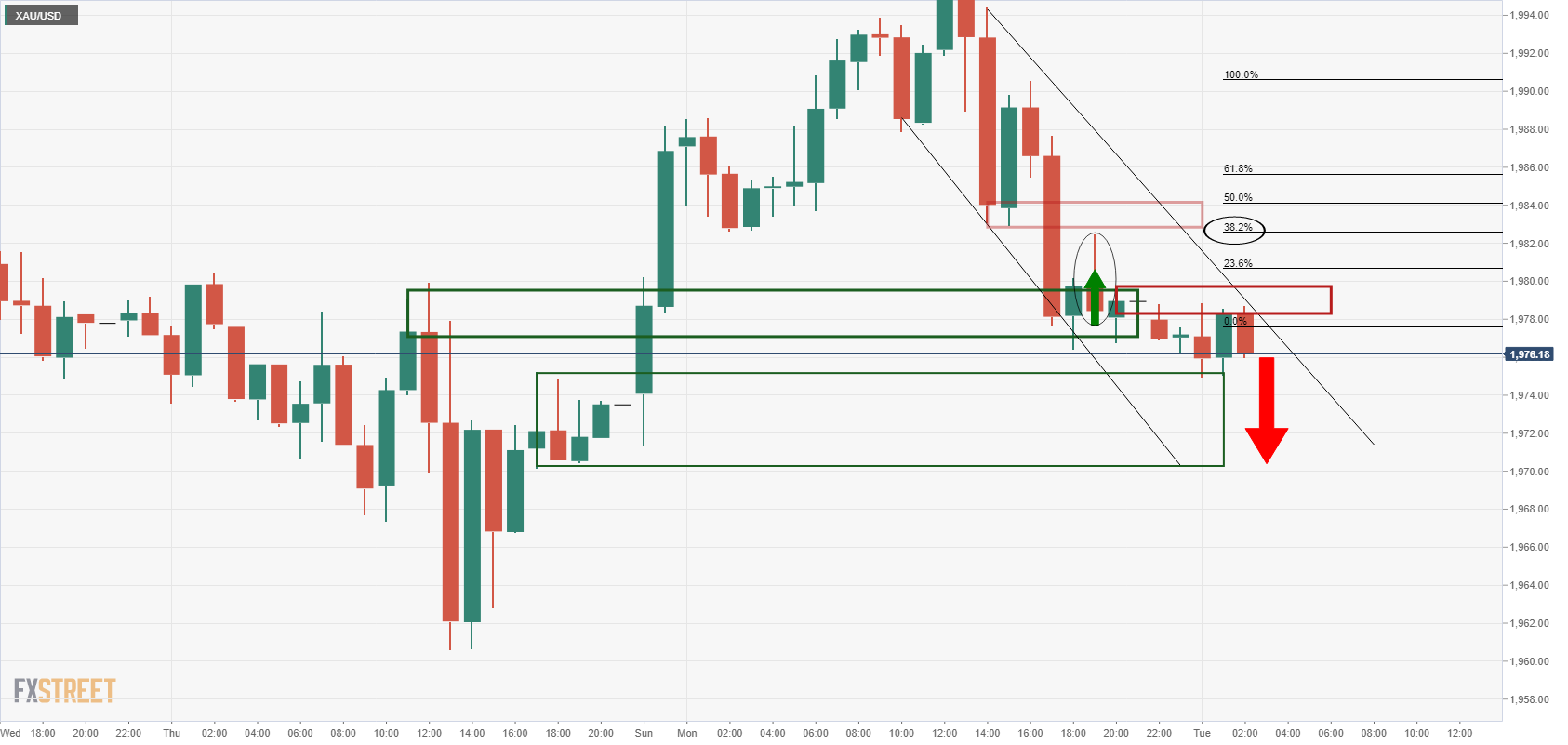

The price is making progress:

The price was rejected near the old lows and has since crumbled, drifting lower and now meeting a freshly established resistance made up of a confluence of the dynamic trendline and horizontal highs.

Key levels to watch

[ad_2]

Source link