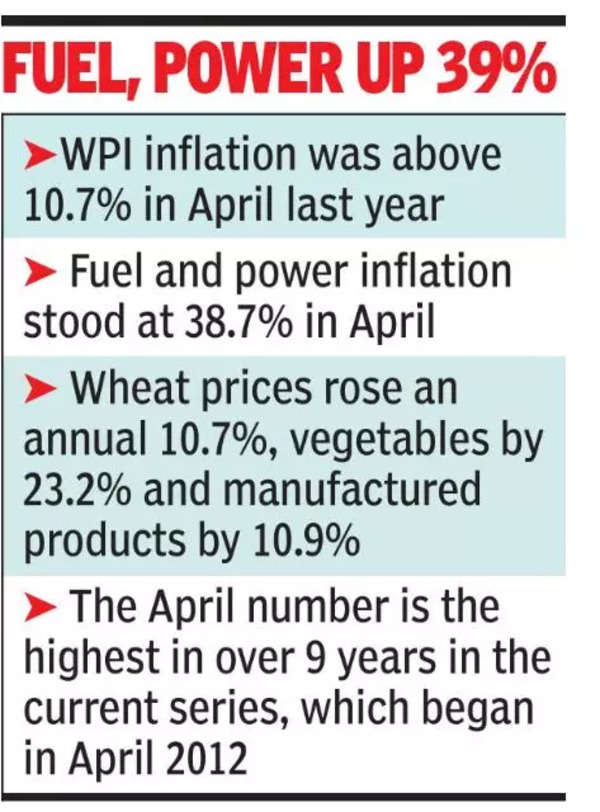

WPI inflation at 9-year high of 15.1%, 13th month of double-digit rise

[ad_1]

The high rate of inflation in April, 2022 was primarily due to the rise in prices of mineral oils, basic metals, crude petroleum and natural gas, food articles, non-food articles, food products and chemicals & chemical products, against a year ago, according to an official statement. The rate of inflation based on the WPI Food Index increased marginally from 8.7% in March to 8.9% in April.

This is the 13th consecutive month of double-digit WPI inflation and the April number is the highest in a shade over nine years in the current series, which began in April 2012. It is the highest in 31 years going by the 1981-82 series when it posted 16.3% in September 1991.

The latest numbers come close on the heels of retail inflation rising to a near-eight year high of 7.8% in April due to surging prices of food and fuel. Economists expect more interest rate increases by the Reserve Bank of India (RBI) in the coming months to cool runaway inflation. The central bank has already raised rates by 40 basis points.

The WPI data showed fuel and power inflation at 38.7% in April. Wheat prices rose an annual 10.7%, vegetables by 23.2%, manufactured products by 10.9%, highlighting the price pressures across the board.

Globally, inflation has emerged as a major risk to economic recovery and has hit household budgets, prompting central banks across the world to aggressively increase interest rates.

“As inflation is primarily supply-driven, we expect upward price pressures to persist in the near term. With recovery in demand, producers are expected to pass on the rising costs to consumers which could push retail inflation even higher,” Rajani Sinha, chief economist at ratings agency CareEdge said in a note.

Economists said the intense heatwave has led to a spike in prices of perishables such as fruits, vegetables and milk, which along with a surge in tea prices and pushed up primary food inflation. They said core-WPI inflation (minus food and fuel) reverted to a four-month-high of 11.1% in April 2022, with producers forced to pass on the input price pressures.

“With WPI inflation remaining solidly in double-digits, the probability of a repo hike in the June 2022 review of monetary policy has risen further. We expect a 40 basis points hike in June 2022 followed by a 35 basis points rise in August 2022, amidst a terminal rate of 5.5% to be reached by mid-2023. With the source of inflation being global supply issues and not exuberant domestic demand, we maintain our view that overtightening will douse the fledgling recovery without having a commensurate impact on the origins of inflationary pressures,” said Aditi Nayar, chief economist at ratings agency ICRA (100 basis points equal a percentage point).

[ad_2]

Source link