U.S. Manufacturing PMI Slides Further in January; Lowest Since September 2020

[ad_1]

TEMPE, AZ — Economic activity in the manufacturing sector grew in January, with the overall economy achieving a 20th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM Report On Business.

The report was issued Feb. 1 by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee:

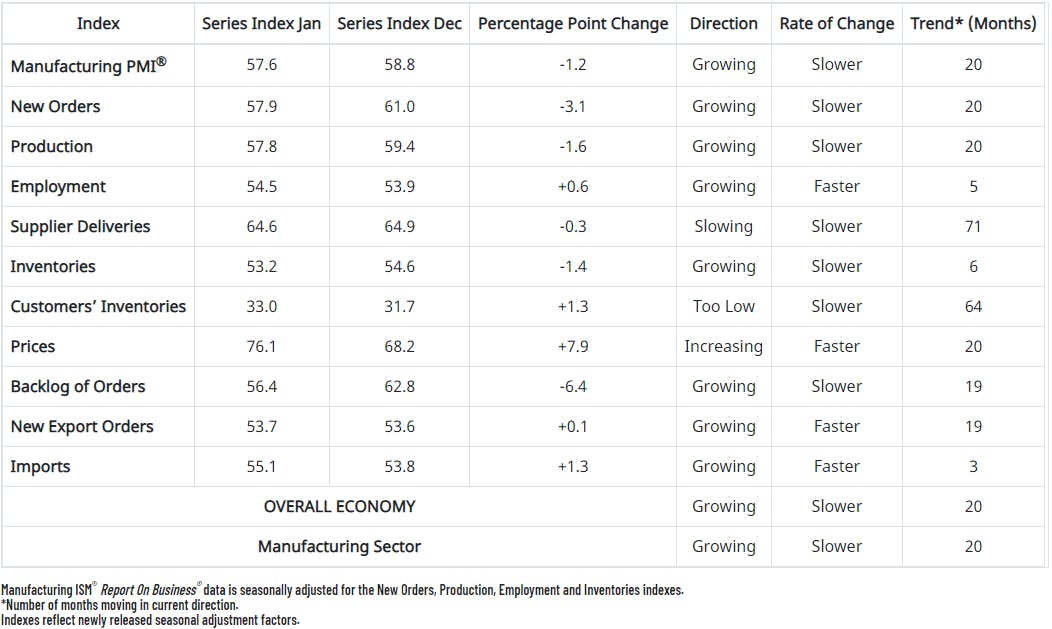

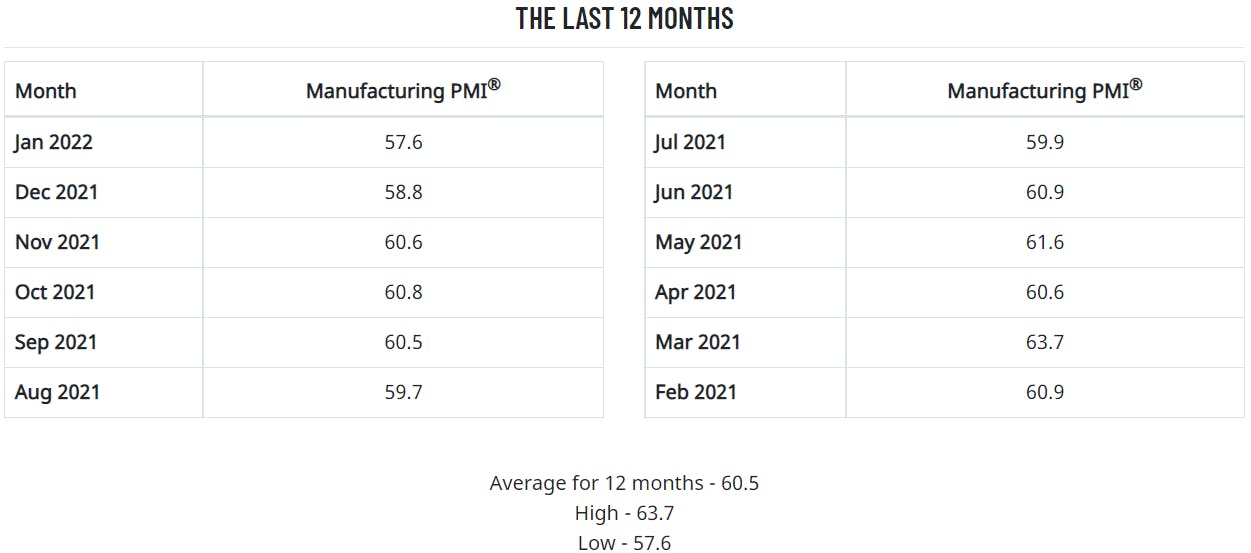

“The January Manufacturing PMI registered 57.6 percent, a decrease of 1.2 percentage points from the seasonally adjusted December reading of 58.8 percent. This figure indicates expansion in the overall economy for the 20th month in a row after a contraction in April and May 2020. The New Orders Index registered 57.9 percent, down 3.1 percentage points compared to the seasonally adjusted December reading of 61 percent. The Production Index registered 57.8 percent, a decrease of 1.6 percentage points compared to the seasonally adjusted December reading of 59.4 percent. The Prices Index registered 76.1 percent, up 7.9 percentage points compared to the December figure of 68.2 percent. The Backlog of Orders Index registered 56.4 percent, 6.4 percentage points lower than the December reading of 62.8 percent. The Employment Index registered 54.5 percent, 0.6 percentage point higher compared to the seasonally adjusted December reading of 53.9 percent. The Supplier Deliveries Index registered 64.6 percent, down 0.3 percentage point from the December figure of 64.9 percent. The Inventories Index registered 53.2 percent, 1.4 percentage points lower than the seasonally adjusted December reading of 54.6 percent. The New Export Orders Index registered 53.7 percent, up 0.1 percentage point compared to the December reading of 53.6 percent. The Imports Index registered 55.1 percent, a 1.3-percentage point increase from the December reading of 53.8 percent.”

ISM

ISM

Fiore continues, “The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment, but January was the third straight month with indications of improvements in labor resources and supplier delivery performance. Still, there were shortages of critical intermediate materials, difficulties in transporting products and lack of direct labor on factory floors due to the COVID-19 omicron variant. Quits rate and early retirements hinder reliable consumption. Panel sentiment remains strongly optimistic, with seven positive growth comments for every cautious comment, up from December’s ratio of 6-to-1. Demand expanded, with the (1) New Orders Index slowing but remaining in strong growth territory, supported by continued expansion of new export orders, (2) Customers’ Inventories Index remaining at a very low level and (3) Backlog of Orders Index slowing but settling at more normal growth levels. Consumption (measured by the Production and Employment indexes) grew during the period, though at a slower rate, with a combined negative 1-percentage point change to the Manufacturing PMI calculation. The Employment Index expanded for a fifth straight month, with signs that ability to hire continues to improve, though somewhat offset by continued challenges of turnover (quits and retirements) and resulting backfilling. Limited expansion strength in production in January, primarily due to absenteeism rates as a result of omicron, was the biggest reason PMI growth was held back. Inputs — expressed as supplier deliveries, inventories, and imports — continued to constrain production expansion, but there are clear indications of improved delivery performance. The Supplier Deliveries Index again slowed while the Inventories Index expanded, both at a slower rate. In January, the Prices Index increased for the 20th consecutive month, at a faster rate (an increase of 7.9 percentage points) compared to December, indicating that supplier pricing power continues to rise.

“All of the six biggest manufacturing industries — Machinery; Food, Beverage & Tobacco Products; Transportation Equipment; Computer & Electronic Products; Chemical Products; and Petroleum & Coal Products, in that order — registered moderate to strong growth in January.

“Manufacturing performed well for the 20th straight month, with demand and consumption registering month-over-month growth. Meeting demand remains a challenge, due to hiring difficulties and labor turnover at all tiers. For the third month in a row, Business Survey Committee panelists’ comments suggest month-over-month improvement on hiring, offset by backfilling required to address employee turnover at a higher rate, supplier performance and improvements in the transportation sector,” says Fiore.

The 14 manufacturing industries reporting growth in January — in the following order — are: Apparel, Leather & Allied Products; Furniture & Related Products; Miscellaneous Manufacturing; Nonmetallic Mineral Products; Machinery; Electrical Equipment, Appliances & Components; Food, Beverage & Tobacco Products; Transportation Equipment; Primary Metals; Fabricated Metal Products; Computer & Electronic Products; Chemical Products; Petroleum & Coal Products; and Plastics & Rubber Products. The only industry reporting a decrease in January compared to December is Paper Products.

ISM

ISM

WHAT RESPONDENTS ARE SAYING

- “We are experiencing massive interruptions to our production due to supplier COVID-19 problems limiting their manufacturing of key raw (materials) like steel cans and chemicals.” [Chemical Products]

- “While there has been some improvement in materials making it to our factories and logistics centers, we are still constrained by (a lack of) qualified labor. Orders so far are not being cancelled, but we are concerned that customers may be losing patience.” [Computer & Electronic Products]

- “Transportation, labor and inflation issues continue to hamper our supply chain and ability to service our customers. Fortunately, it’s also hampering our competition as well. Ultimately, the biggest impact is at the consumer level, as (price increases) continue to get passed through.” [Transportation Equipment]

- “Our suppliers are having difficulty meeting scheduled releases as their suppliers experience delays and shortages, so lead times and inventories are struggling, resulting in lost production.” [Food, Beverage & Tobacco Products]

- “Lack of skilled production personnel, either from missing work due to (COVID-19) variants or leaving for better opportunities, making it more difficult to complete work. Working off a backlog.” [Fabricated Metal Products]

- “Strong backlog of orders coming into the new year. Potential to beat target revenue, depending on availability of purchased product.” [Electrical Equipment, Appliances & Components]

- “Bookings continue to increase as we are still dealing with a shortage of labor and supply chain issues.” [Furniture & Related Products]

- “Transportation restrictions and a lack of supplier manpower continue to create significant shortages that limit our production. This, in turn, limits what we can supply to customers, as well as on-time delivery.” [Machinery]

- “Integrated circuit availability is really causing issues. Shortages of raw materials and other electronic materials continue to hamper deliveries to our customers.” [Miscellaneous Manufacturing]

- “The supply chain crunch may be loosening a bit; however, specific original equipment manufacturer (OEM) parts and equipment now have lead times that we have not experienced before.” [Nonmetallic Mineral Products]

Commodities Up in Price

Adhesives and Paint (2); Aluminum (20); Aluminum Products; Calcium Carbonate; Caustic; Copper; Corrugated Packaging (15); Crude Oil*; Diesel Fuel (13); Electrical Components (14); Electronic Assemblies; Electronic Components (14); Freight (15); Hydraulic Components; Labor — Temporary (9); Lubricants (2); Lumber (2); Lumber — Pallets; Natural Gas* (7); Ocean Freight (14); Packaging Film; Packaging Supplies (14); Paper Products; Plastic Resins; Resin Based Products (12); Ridged Plastic Packaging Products; Rubber Based Products (6); Semiconductors (12); Soy Based Products; Steel* (18); Steel — Hot Rolled*; Steel — Stainless (15); Steel Drums; Steel Products* (17); Vegetable Based Oils; and Zinc Compounds.

Commodities Down in Price

Crude Oil* (2); Natural Gas* (2); Plastic Resins; Steel* (3); Steel — Carbon; Steel — Hot Rolled* (3); Steel — Scrap; and Steel Products*.

Commodities in Short Supply

Aluminum (3); Aluminum Products; Brass; Caustic; Corrugate; Electrical Components (16); Electronic Components (14); Epoxy; Labor — Temporary (9); Ocean Freight; Paper; Plastic Resins — Other (11); Printed Circuit Board Assemblies; Ridged Plastic Packaging Products; Semiconductors (14); and Steel Products.

Note: The number of consecutive months the commodity is listed is indicated after each item.

*Indicates both up and down in price.

[ad_2]

Source link