Top 10 Motorcycles 150cc To 200cc Apr 2022 – FZ, R15, MT15, Apache, Pulsar

[ad_1]

Yamaha FZ was the best selling model in this segment in the past month while the Unicorn 160 was at No.2

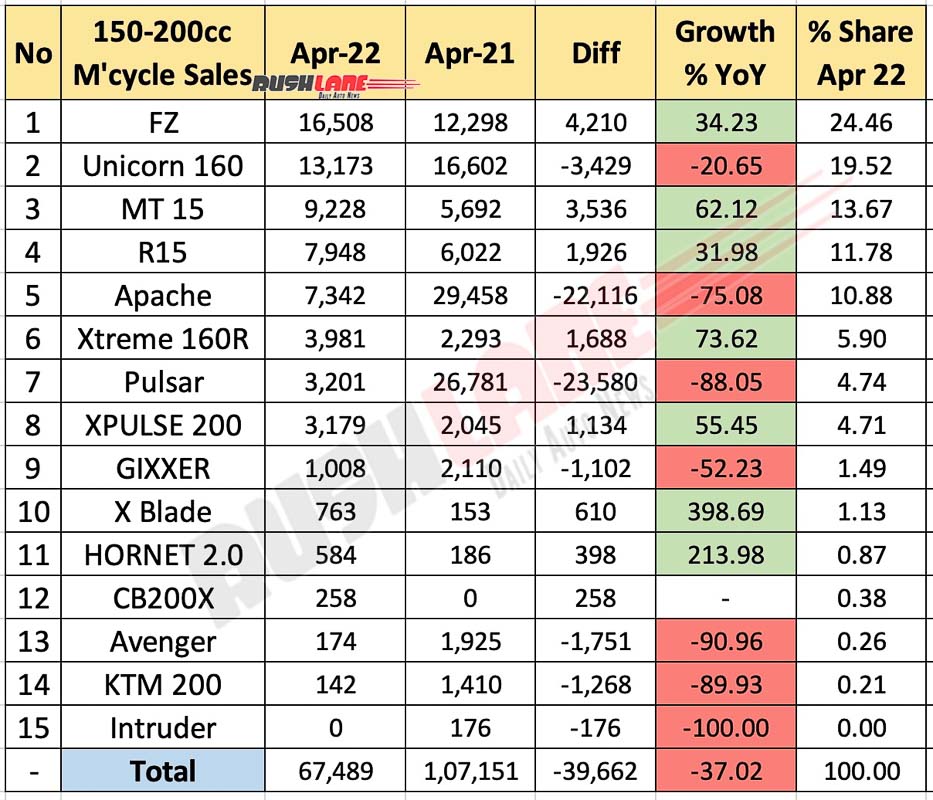

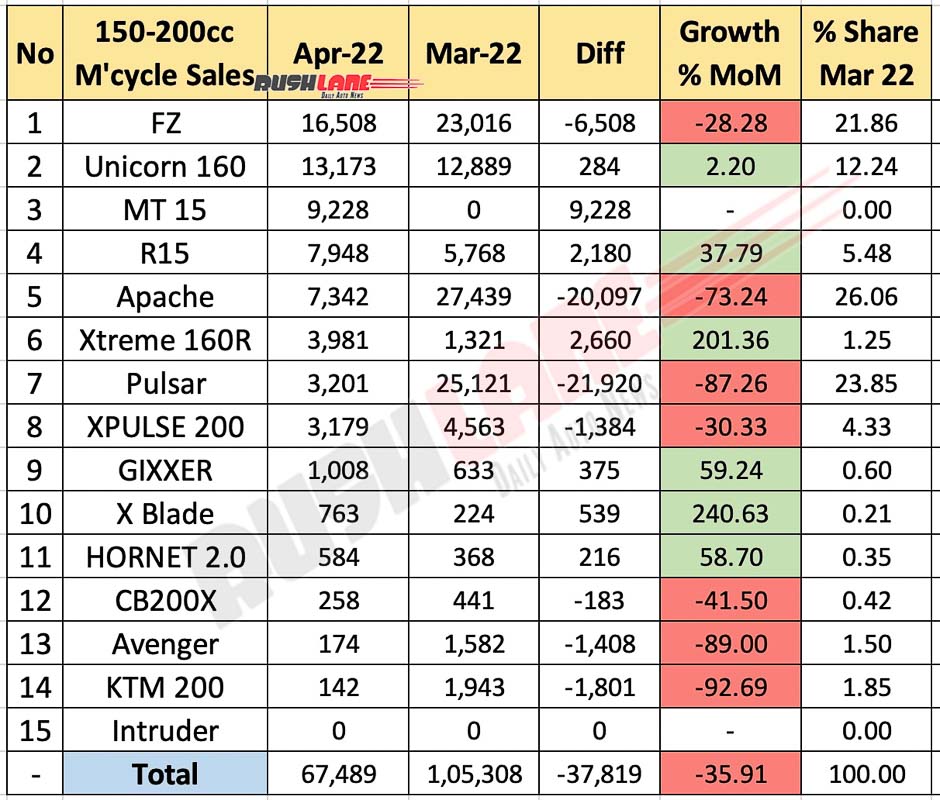

Sales in the 150-200cc segment have been lackluster since the start of this calendar year. Sales had stood at 89,509 units in January 2022 but fell to 85,470 units in Feb 2022. Improvement was seen in March to 1,05,308 units but has again dipped in April 2022 to 67,489 units.

Total sales in this segment that had stood at 67,489 units last month fell 37.02 percent YoY over 1,07,151 units sold in April 2022. It was also a MoM degrowth of 35.91 percent over 1,05,308 units sold in March 2022. Rising fuel prices, a skewed economy, price hikes announced by a host of two wheeler makers could be reasons for this dip in demand.

Top 10 Motorcycles 150cc To 200cc Apr 2022 – YoY

Usually the battle for top in this segment is between TVS Apache and Bajaj Pulsar. But that is not the case for April 2022. It was Yamaha FZ that headed top 10 sales charts with 16,508 units in the past month, up 34.23 percent over 12,298 units sold in April 2021. This was a volume growth of 4,210 units and a 24.46 percent market share. MoM sales however, dipped 28.28 percent from 23,016 units sold in March 2022. Yamaha FZ currently retails at Rs 1.09 lakh and Rs 1.18 lakh (ex-showroom) for its standard version and FZ-S variants respectively.

Sales of Unicorn 160 dipped YoY by 20.65 percent to 13,173 units from 16,602 units sold in April 2021. MoM sales improved 2.20 percent over 12,889 units sold in March 2022. Market share also improved MoM from 12.24 percent held in March 2022 to 19.52 percent in the past month. At No. 3 was Yamaha MT15 with a 62.12 percent YoY growth to 9,228 units, up from 5,692 units sold in April 2021. This was a 3,536 unit volume growth with a 13.67 percent market share. In March 2022 there were 0 units of the MT15 sold due to the fact that it was not on sale.

There was also the Yamaha R15 at No. 4 with sales of 7,948 units, up 31.98 percent YoY over 6,022 units sold in April 2021. MoM sales also increased 37.79 percent from 5,768 units sold in March 2022 bringing up market share from 5.48 percent to 11.78 percent. From May 2022, Yamaha India has hiked prices of R15, FZS, Aerox, Fascino and RayZR in view of rising input costs.

Apache, Xtreme 160R, Pulsar

TVS Apache suffered a YoY de-growth of 75.08 percent and MoM de-growth of 73.24 percent to 7,342 units. Sales stood at 29,458 units in April 2021 and at 27,439 units in March 2022. TVS Apache prices have also been hiked from June 2022 across all variants and now sells at Rs 1,12,940-Rs 2,65,000 (ex-showroom).

Lower down the order on the list of best-selling motorcycles in the 150-200cc segment was Hero XTreme 160R. Sales increased substantially both on YoY and MoM basis to 3,981 units, up 73.62 percent over 2,293 units sold in April 2021 and up 201.36 percent from 1,321 units sold in March 2022.

Bajaj Pulsar sales suffered YoY and MoM degrowth down 88.05 percent to 3,201 units from 26,871 units sold in April 2021 and down 87.26 percent from 25,121 units sold in March 2022. Bajaj Auto has increased prices across range in May 2022 by a maximum of Rs 4,900. The Pulsar range sees prices increased by Rs 1,299 to Rs 4,800 depending on variant and now retails from Rs 81,389 to Rs 1,44,979.

XPulse 200 (3,179 units) XBlade (763 units) and Hornet 2.0 (584 units) also saw a YoY growth in sales while Gixxer (1,008 units) suffered YoY degrowth in April 2022. There were also 258 units of the CB200X, 174 units of the Avenger and 142 units of the KTM200 sold last month but 0 units of the Intruder.

[ad_2]

Source link