RBI Governor: Rate hikes in next monetary policy meets ‘a no-brainer’, Says Shaktikanta Das | India Business News

[ad_1]

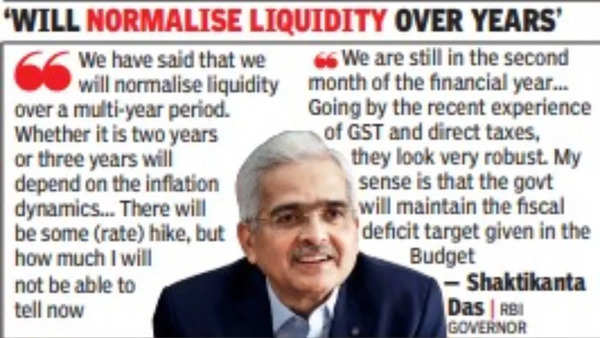

In an interview with a TV channel, Das said that “I have said in the minutes of the monetary policy committee meeting that one reason for the off-cycle meeting in May was to avoid a stronger action in June.” He added that RBI cannot hike rates sharply in one go. On the withdrawal of liquidity, Das said “We have said that we will normalise liquidity over a multi-year period could. Whether it is two years or three years will depend on the inflation dynamics,” he said. According to Das, normalisation of liquidity would not necessarily mean a return to the pre-Covid level as while the economy has grown in size and inflation dynamics have also changed.

In the minutes of the policy meeting, RBI deputy governor Michael Patra has spoken about the need to reverse the rate cuts made during the pandemic. The market saw this as RBI targeting a repo rate of 5.15%. “The expectation of rate hike, it’s a no-brainer. There will be some hike, but how much I will not be able to tell now. To say 5.15% may not be very accurate,” said Das.

“Interest rates in almost every country today are negative, except Russia and Brazil. The target for inflation for advanced economies is about 2%. Except for Japan and one more country, all advanced economies have inflation of over 7%,” he said. “We will move towards that (positive real rates), it is not possible to forecast how soon because the situation is so dynamic. For example, the inflation metric changes because of our actions and action of the government,” said Das.

The governor’s interview comes two days after the government cut tax on fuel prices to supplement RBI’s efforts to combat rising prices. Consumer price inflation increased to 7.8% in April 2022, up from around 7% in the previous month. Seeking to quash speculation that the government borrowing would increase by Rs 1 lakh crore because of the cut in fuel taxes, Das said.

“There is no one-to-one correlation between the government expenditure and borrowing.

[ad_2]

Source link