Maruti’s Upcoming New SUVs – Targets To End Creta, Nexon Dominance

[ad_1]

Maruti Suzuki is set to increase focus on SUVs while MPVs and Hatchbacks do the heavy lifting in the meantime

You don’t have to be a genius to know that Maruti Suzuki is the largest passenger vehicle maker in India. They dominate most segments they enter. But their sales have been on a decline in recent years, and that is clearly visible when you notice the market share report.

Maruti Suzuki had a 43.65% market share in PV segment for FY22, down from 51.22% in FY2020. In non-SUV segments, Maruti Suzuki had a 66.5% market share last year. And in MPV segment, they had a 61% market share. At the same time, in SUV segment, its share was only 12%.

Maruti Aims To Become No 1 SUV Maker Of India

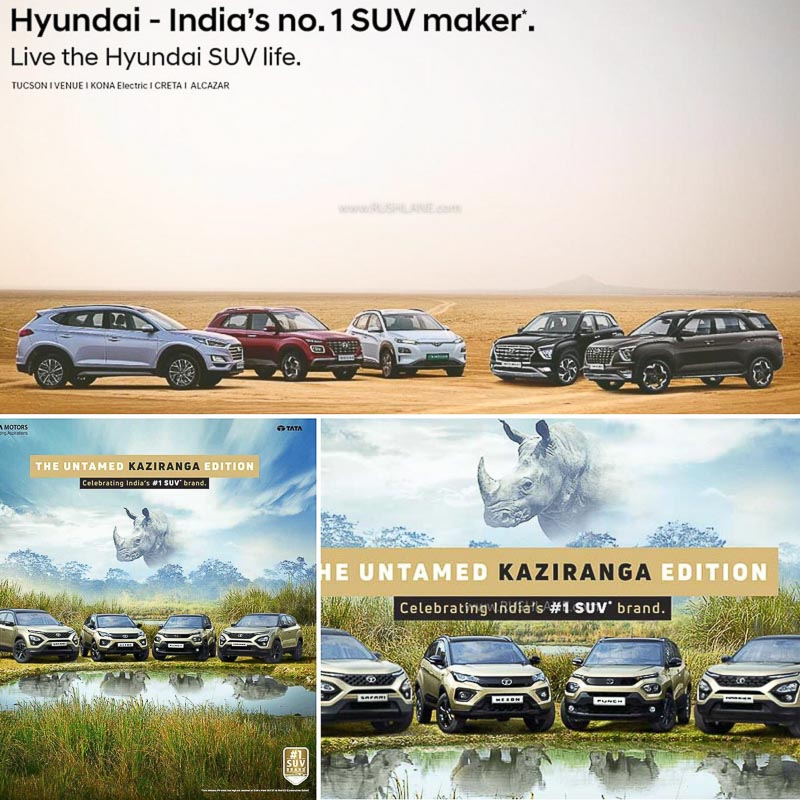

The biggest reason behind Maruti losing market share in the last few years, is because they failed to launch enough SUVs to meet market demand. This is where Hyundai and Tata Motors are dominating currently. In FY22, Hyundai sold 2.5 lakh SUVs, Tata sold 2.05 lakh SUVs. Mahindra too is fast catching up. Whereas, Maruti sold 1.34 lakh SUVs in FY22. Economic Times reports that Maruti aims to more than double this in FY23, their target SUV sale for this fiscal is 3 lakh – beating Tata and Hyundai.

Maruti Suzuki aims at least 50% of the market share at any given point across all segments. To achieve it in a market like India where car buying trends are rapidly shifting toward lifestyle-oriented and feature-rich vehicles is very difficult. Maruti Suzuki has to tackle Indian market across all segments and most importantly, SUVs. To do that, Maruti Suzuki is shifting focus on introducing more SUVs in the market. The 43.65% market share Maruti Suzuki enjoys in India, majorly comes from its budget hatchbacks and MPVs.

Except for Brezza, they’ve never had any real success with SUVs. They had Grand Vitara which never took off. They also had Gypsy, but was out-dated to compete with modern cars. S-Presso is not really an SUV. S-Cross is a crossover reflected in the very name, it failed to get recognized as an SUV. So, it is just the Brezza. Rest of the vehicles actually bring in a chunk of sales figures for Maruti Suzuki. This has kept sales charts high despite the void in SUV segment.

Another factor that has led to the decline of sales for Maruti Suzuki is the absence of a diesel engine across its portfolio. Despite Maruti Suzuki’s attempts in pushing the country toward a greener future, there is still a good demand for diesel-powered passenger cars. That is where manufacturers like Tata, Mahindra and Hyundai are currently partying.

Maruti Suzuki has strived very hard to replace diesel-powered cars with CNG and it has worked surprisingly well. Around 48% of Ertiga MPVs sold today are CNG powered. CNG is being accepted as a diesel alternative in India and demand for CNG-powered vehicles is on the rise. This is reflected in the fact that premium cars like Alcazar, Creta and Seltos have been testing with CNG options too.

Upcoming Maruti SUVs

Maruti Suzuki is replacing the ageing current-gen Brezza with new model by the end of this month. While B-segment SUV space is taken care by the upcoming Brezza, company’s Creta rivaling SUV codenamed YFG, will take care of C-segment SUV space. Co-developed with Toyota, YFG is expected to come with a mild hybrid and a high-voltage hybrid variant making them the most advanced SUVs in the segment.

The next SUV will be Baleno Cross, codenamed YTB. It is expected to debut at the 2023 Auto Expo early next year. After that, Maruti has 5-door Jimny planned, targeting the lifestyle offroad segment where Mahindra Thar and Force Gurkha are partying. With Brezza, Maruti Suzuki will compete against segment leader Tata Nexon and others like Toyota Urban Cruiser, Mahindra XUV300, Hyundai Venue and Kia Sonet. With the upcoming YFG, Maruti Suzuki will compete with Hyundai Creta, Kia Seltos, Toyota’s upcoming D22 (HyRyder), MG Astor, VW Taigun, Skoda Kushaq and upcoming Scorpio-N. This way, Maruti Suzuki is targeting a front seat in SUV race, thereby breaking the jinx that they have in SUV sales.

Total car sales in India this fiscal are expected to be around 36 lakh units. If we take 30-40% of those to be SUVs, that will be about 12-14 lakh SUV sales in FY 2023. Of this, if Maruti manages 3 lakh SUV sales, it will be 25% of the SUV market share in FY2023.

[ad_2]

Source link