Inflation in wholesale prices: Looking back, looking ahead

[ad_1]

Since the start of the inflation-targeting regime of RBI, most of the focus has been on consumer price inflation. That’s because that is the inflation rate that RBI seeks to target and keep at the 4% mark. But over the past year, the inflation in wholesale prices has been surging in a rather unprecedented manner.

Since April last year, WPI (wholesale price index) based inflation has been above 10% in every single month. In April 2022, as the latest data from the Department for Promotion of Industry and Internal Trade shows, WPI inflation crossed another psychological mark: it went beyond 15%.

This is the 13th month of double-digit inflation growth and, as such, now rules out arguments that a low base effect is in play. For instance, the inflation in April last year was 10.7%. The 15% spike comes on top of that 10.7% spike in wholesale prices.

With such high levels of headline inflation, it is clear that most components of WPI are witnessing high inflation.

What’s fuelling WPI inflation?

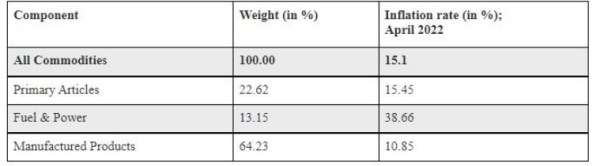

Table below provides both the inflation rate as well as the weight of different sub-components. It is important to note the weight in order to understand the overall impact of inflation in any single component.

Composition of Wholesale Price Index (Source: MoSPI)

Composition of Wholesale Price Index (Source: MoSPI)

As can be seen, while the highest inflation has been in fuel prices, it is the smallest contributor to the overall index. Similarly, while manufactured products inflation is the least — albeit in double digits — it is likely to have had almost six-times the impact on the overall inflation because of the weight.

This chart shows how different components have been witnessing inflation.

This chart shows how different components have been witnessing inflation.

Food inflation has been hovering around the 9%-mark since December 2021. According to Aditi Nayar, Chief Economist, ICRA Limited, “The heatwave led to a spike in prices of perishables such as fruits, vegetables and milk, which along with a spike in tea prices pushed up the primary food inflation”.

On the face of it, the most egregious culprit appears to be the spike in fuel prices. In April, this component witnessed a spike of nearly 39%. But while the Ukraine crisis may have been the most proximate reason, the fact is that fuel price inflation has been soaring right through the past year (see CHART 1), long before the Ukraine invasion.

However, one must keep in mind the relatively low weight of fuel prices in the index.

The biggest push would be coming from the inflation in manufactured products; it has been in double digits for most of the past 12 months.

What to expect?

There is no one-to-one correlation between wholesale price inflation and retail inflation. However, RBI’s studies have found that an increase in WPI-food inflation tends to have a “significant” impact on retail food inflation. In other words, when wholesale food inflation goes up, it leads to higher food prices for consumers as well.

It is noteworthy that retail food inflation was already pretty high at 8.3% in April. Over the next two months, one can expect retail food prices to possibly increase further simply on account of higher food inflation in the wholesale market.

What’s even worse, however, is that higher retail prices of food tend to spike wholesale food prices in turn. In other words, one can get into a vicious cycle if inflation is left unaddressed.

Lastly, even though RBI does not target WPI inflation does not mean it does not monitor it. Imported inflation in the form of high energy and commodity prices is a fact of life, and it will continue to force RBI to take action.

High WPI inflation will further convince RBI to raise interest rates and do so urgently. Expect interest rates to go up by at least 75 basis points (that is three-fourth of a percentage point) in the next two months.

The flip-side of raising interest rates sharply, however, is that they will dampen the overall demand in the Indian economy at a time when overall consumer demand is still fledgling.

The RBI, thus, has a tough balancing act to perform: contain inflation (especially from sources over which it has no control, such as high fuel prices) while ensuring not snuffing out domestic economic recovery.

Newsletter | Click to get the day’s best explainers in your inbox

[ad_2]

Source link