Honda to Maruti, carmakers eye strong mid-size hybrids to ease switch to EVs

[ad_1]

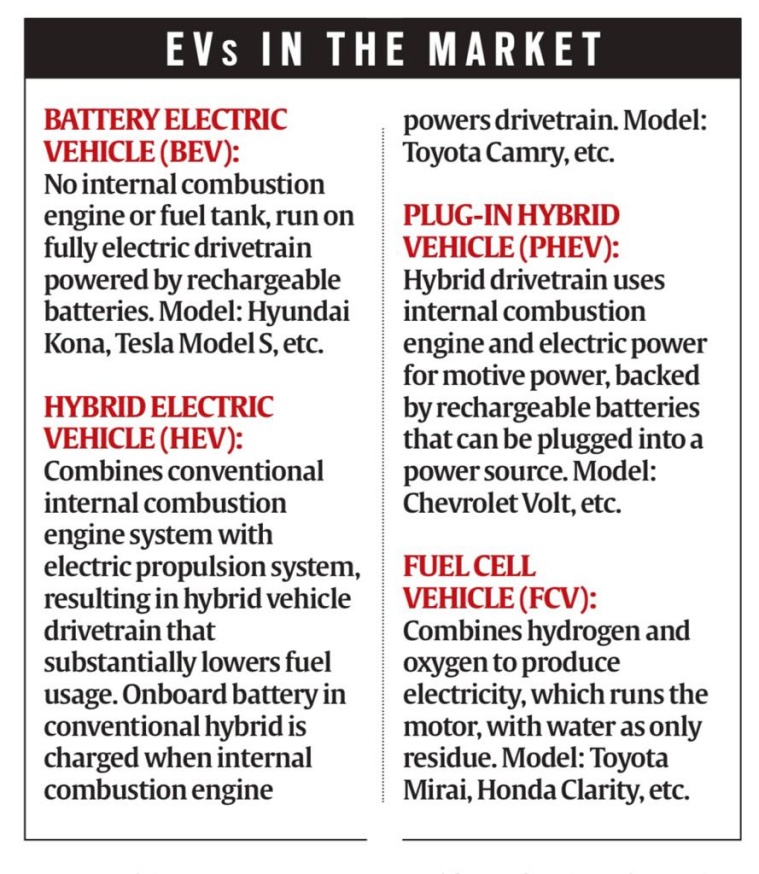

THE NEED for charging infrastructure as a prerequisite for battery electric vehicles to find more space in the market is driving four-wheeler vehicle makers to introduce hybrid electric options — cars that feature an internal combustion engine alongside an electric motor — in the mid-size vehicle segment.

Honda Cars India has announced a hybrid version of its sedan City, which is the first “strong hybrid” in its class, comprising a full-fledged hybrid system with two large electric motors and a big battery pack in the trunk.

The country’s largest carmaker, Maruti Suzuki, is working on a strong hybrid vehicle as part of its parent company Suzuki Motors’ global partnership with Toyota, with more vehicles likely under the technology tie-up between the two Japanese carmakers.

One of the main reasons why carmakers are increasingly focusing on hybrid vehicles is that the price is not as high as battery EVs. Besides, hybrid EVs also have combustion engines and hence are not dependent on an extensive charging infrastructure.

“Hybrid technology is an important technology. EV is a very good solution but hybrids can also contribute a lot, and cost-wise it is not as expensive as EV. Hybrid is a technology that can contribute greatly to the Co2 emission situation in India and even without the infrastructure, we can develop the market because it does not need charging infrastructure. We will introduce strong hybrid products in the not-so-distant future,” Maruti Suzuki India’s newly appointed MD & CEO Hisashi Takeuchi said.

The country’s largest carmaker, Maruti Suzuki, is working on a strong hybrid vehicle as part of its parent company Suzuki Motors’ global partnership with Toyota, with more vehicles likely under the technology tie-up between the two Japanese carmakers.

The country’s largest carmaker, Maruti Suzuki, is working on a strong hybrid vehicle as part of its parent company Suzuki Motors’ global partnership with Toyota, with more vehicles likely under the technology tie-up between the two Japanese carmakers.

Currently, Maruti Suzuki offers four vehicles — Ertiga, Ciaz, S-Cross and Vitara Brezza — on the “mild hybrid” technology. The key difference between a mild hybrid and a strong or full hybrid car is that the former cannot drive on pure battery alone unlike the other two.

Honda’s new City eHEV has two large electric motors that will ensure the car might be more fuel efficient than most compact hatchbacks. In Honda’s hybrid system, the powerful electric motors are mated to a 1.5-litre 4-cylinder petrol engine. One of the two on-board motors in the car mainly works as an electric generator, while the other functions as a propulsion motor.

While the car is likely to be more expensive than others in its class, the mileage is the biggest draw: there are expectations of an ARAI figure in India of around 25kpl, and over 20kpl in real world driving conditions.

One of the trickle-down effects of an increasing portfolio of hybrid vehicles is the expansion of carmakers into building components locally, which could translate into the setting up of a full electric vehicle manufacturing ecosystem in India.

Strong hybrid electric vehicles, which do not need charging, are also seen as a practical first step in the transition towards electric vehicles, given that customers are not subject to range anxiety and there is no need for an extensive charging infrastructure.

Despite a broader push towards hybrid electric vehicles, it is the Battery EVs (BEV) that are predominantly available in the market currently as alternatives to combustion engine cars. However, the lack of charging infrastructure means that not many buyers have flocked to buy BEVs in the country. In financial year 2021-22 (April-March), only 17,802 electric cars were sold in the country, much of which were BEVs, compared to a total of 27.26 lakh passenger vehicles sold during the year, according to data released by Federation Of Automobile Dealers Associations (FADA).

But one of the hurdles in the way of the potential success of hybrid vehicles in India is the taxation structure. Currently, hybrid vehicles attract a GST of 28 per cent on models under four metres in length, while those larger are taxed at 43 per cent. Compared to this, BEVs such as Tata Motors’ Nexon or Hyundai’s Kona SUV draw subsidies under the Government’s FAME scheme to promote electric vehicles.

This arbitrage in taxation also means that BEVs will currently be more within the reach of car buyers. Maruti Suzuki has announced the launch of its BEV by 2025, while setting up a battery manufacturing unit on land near its Gujarat plant.

[ad_2]

Source link