Govt considers windfall tax on oil and gas giants | Latest News India

[ad_1]

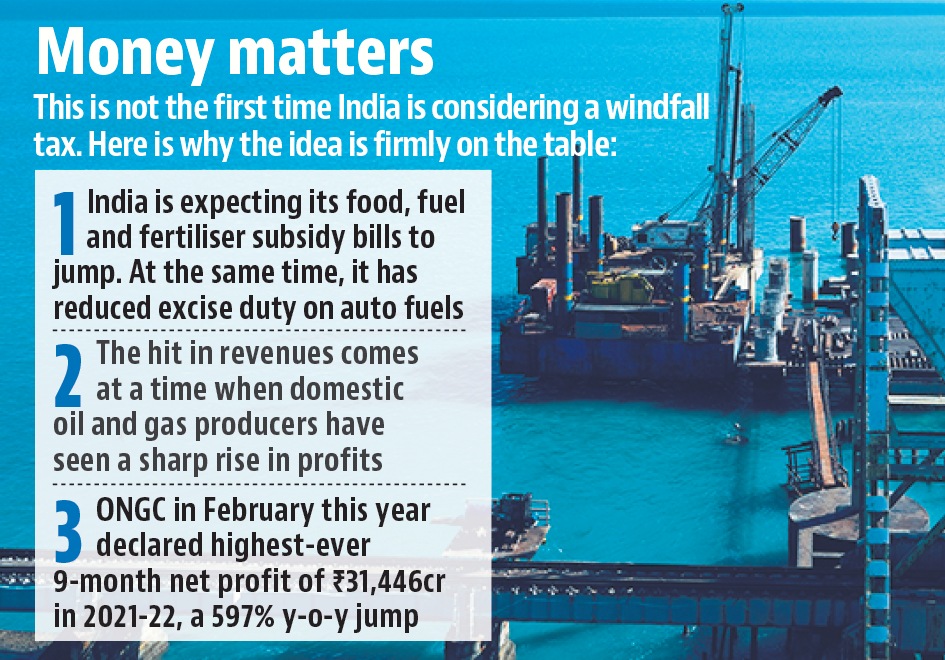

India is considering a so-called windfall tax on oil and gas producers (state-owned as well as private) to offset ballooning public expenditure on fuel, food and fertiliser subsidies amid skyrocketing inflation, two people familiar with the development said on condition of anonymity.

The tax, which may be levied when oil prices, for instance, cross a certain level, will boost the government’s finances, and help fund efforts to protect vulnerable sections from rampant inflation.

Windfall tax is, simply, a tax levied on companies whose financials have been boosted purely by luck, or events for which they are not responsible. For instance, energy companies have benefitted from the global spike in energy prices on account of Russia’s invasion of Ukraine.

The UK, on Thursday, announced a 25% windfall tax on profits of oil and gas companies.

In India, the people cited in the first instance said that domestic oil and gas producers have seen a sharp rise in profits, with some exporting auto fuels even as their local pumps are dry. A final decision on this matter would, however, be taken by the competent authority in an appropriate time, they added.

This is not the first time India is considering a windfall tax. Policymakers flirted with the idea in 2018, and before that in 2008, when oil prices were on a high, and many Indian oil producers made a killing. Both times, the idea was abandoned, after it was strongly opposed by private oil companies (which account for a sliver of the business in India that is dominated by state-owned firms).

“Alternatively, the government may seek higher dividend from public sector companies as the biggest oil producer is public sector , but that would give a free pass to private players. Shouldn’t they also share a part of their windfall gains in this time of crisis that is created by global factors?” one of the two people asked.

The second person pointed out that even developed countries are resorting to windfall tax to raise funds to foot additional subsidy bills. “Soaring energy prices, which is one of the key reasons for high inflation rates across the globe. UK, Spain, Italy, Hungary all are resorting to some kind of windfall tax to subsidise food and fuel bills of their citizens,” he said.

Hungary on Wednesday announced its intent to levy windfall taxes on additional profits earned by various sectors, including energy firms, for a two-year period to fund subsidies. Italy also decreed energy firms to pay by a 25% one-off levy to subsidise energy costs of both consumers and businesses.

India, which is committed to protecting farmers and the poor from inflation, is expecting its food, fuel and fertiliser subsidy bills to jump significantly, especially after it has reduced central excise duty on auto fuels twice in six months impacting revenues worth ₹2.20 lakh crore. Besides, the Union government is to pay additional fertiliser subsidy of ₹1.10 lakh crore (total at record ₹2.15 lakh crore), free dry ration costing ₹80,000 crore a year to the poor, which in all probability would be extended beyond September 2022. The subsidy bills are expected to jump further if global situation does not improve and inflationary pressure continues, the people said.

“Although we are in the first quarter of 2022-23 and the budget has some built-in fiscal space to accommodate some of the expenditure, rising expenditure, and no immediate end to the global crisis, necessitates exploring options for generating additional resource generation, if needed,” the first person said.

The ministries of finance and petroleum did not respond to e-mail queries.

Back in 2018, the plan was to plough this back to fuel retailers and push them to keep prices steady.

Commenting on windfall gains by domestic oil and gas producers, the two people said it is interesting to note that producers’ sales have surged and they have made handsome profits despite oil and gas output from their fields being either stagnant or falling. “It seems that they have lost incentive to explore more and ramp up production because of easy money they get because of a spike in international oil prices,” the second person said.

According to the latest official data, India energy firms produced 2.47 million tonnes of crude oil in April compared to 2.5 million tonnes in the same month last year. While natural gas output rose 6.6% to 2.82 billion cubic meters in April this year because of higher output from Reliance Industries’ KG-D6 block, Oil & Natural Gas Corporation’s (ONGC) gas output fell by 1% to 1.7 billion cubic meters.

State-run energy firms ONGC and Oil India Ltd (OIL) are expected to announce their financial results by this weekend. India’s biggest explorer ONGC in February this year declared highest ever nine-month net profit of ₹31,446 crore in 2021-22, a 597% year-on-year jump even as its oil and gas output during the period fell by 3.9% and 5.2% respectively.

SC Sharma, an energy expert and former officer on special duty at the erstwhile Planning Commission said: “Some of the oil importing and producing nations have been examining the windfall gain tax on oil and gas production which Indian government may also be examining.” He added that the move may not be a suitable for India to as country’s oil and gas production is not very significant.

He said higher dividend from state-owned oil companies is the best option. “The option government can think is to levy higher dividend from these companies… as government companies produce about 85% to 90% of oil and gas.”

Experts also said government needs additional resources to manage inflation and growth. Gagan Dixit, vice president at equity research firm Elara Capital said: “Upstream PSUs [ONGC and OIL] are benefitting from multiple ways, like higher crude prices, anticipated further APM gas price hike to USD9/mmbtu by October 2022 and the rupee weakening. We believe clarity on any additional cess on upstream would be known after ONGC and Oil India results.”

[ad_2]

Source link