Explained: The cause and effect of rising inflation

[ad_1]

On Thursday, official data revealed that retail inflation had grown by 7.8% in April. In other words, the general price level Indian consumers faced was almost 8% higher than it was in April last year.

This is not only the highest rate in the last eight years but also almost twice the inflation rate targeted by the Reserve Bank of India. According to law, since October 2016, the RBI is required to maintain retail inflation at a level of 4%; it is, however, given a leeway of two percentage points on either side — that is, in a particular month, inflation can either fall as low as 2% or rise as much as 6%.

Is the April spike because of Ukraine?

While the war in Ukraine and the associated inflation via higher prices of crude oil are a significant contributor, April’s high inflation data is neither unexpected nor a one-off spike.

Retail inflation has been high since October 2019 and has, in fact, touched the 4% mark just once since then. In all other months, it has been not only been higher than 4% but regularly breached the 6% mark.

April’s inflation is the seventh straight month when inflation rate has gone up. Further, inflation in India has been above 6% since the start of 2022 (before Russia’s invasion of Ukraine happened in February) and the eventual pass-through of the higher crude oil prices to domestic consumers (which started happening in late March after elections to five Assemblies were completed).

What is worse is that most analysts expect retail inflation to remain outside that comfort zone (6%) for the rest of the year as well.

So, what is driving inflation?

Headline inflation has been above the 4% mark since 2019-20 — the year when the current Narendra Modi government won its second term. Headline inflation is calculated using the Consumer Price Index. This index had different categories with varying weights. There are three main categories:

FOOD ITEMS, which account for 46% of the index;

FUEL & LIGHT, with a weight of 7%;

CORE, all other items, which make up the remaining 47%.

Given the different weights, it is important to understand that a 10% increase in food items will obviously raise the overall inflation far more than a 10% increase in fuel prices.

As the years have rolled by, overall inflation has been driven by more and more factors. In 2019-20, when overall inflation was 4.8%, the main reason was a 6% spike in food prices.

And in 2020-21, when the pandemic hit the economy, food prices rose by an even larger factor (7.3%) and even core inflation rose by 5.5%.

But until then, fuel price inflation was still low — 1.3% in 2019-20 and 2.7% in 2020-21. In 2021-22, the year when the global economy started recovering sharply, even though food price inflation moderated to 4%, fuel prices rose by 11.3% and core inflation went up to 6%.

In the current financial year, it is estimated that all three components will experience an inflation rate of 6% or more.

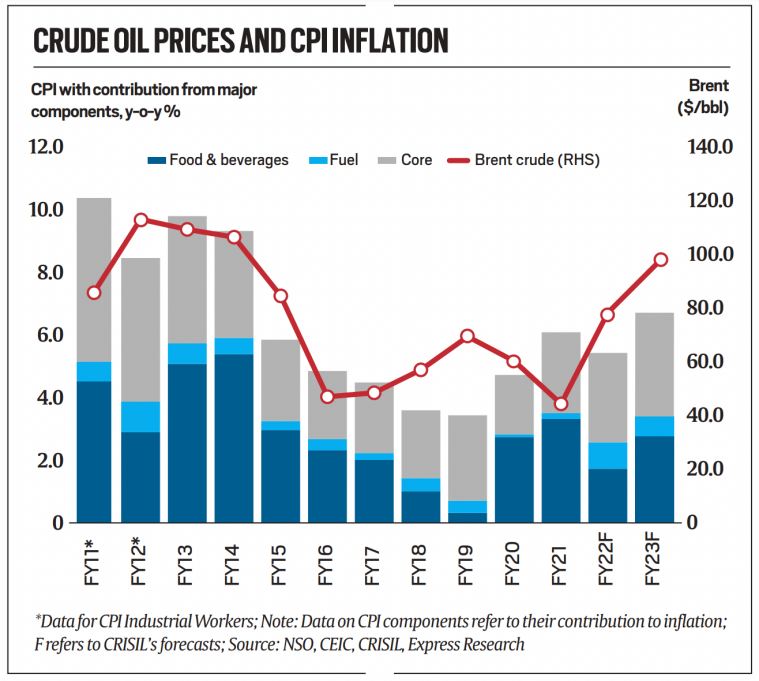

Crude oil prices and CPI inflation

Crude oil prices and CPI inflation

What are the effects of high inflation?

In the short term, inflation creates winners and losers, but in the eventual analysis, everyone suffers if it stays persistently high.

Some of the likely impacts of inflation:

* It reduces people’s purchasing power. Given the actual observed inflation as well as the expected inflation in the current year, the general price level at the end of 2022 would be around 25% higher than it was at the start of 2019. Even in normal times, this would have restricted people’s ability to purchase things, but coupled with reduced incomes and job losses, households would struggle even more. The poor are the worst affected because they have little buffer to sustain through long periods of high inflation.

* It reduces overall demand. The eventual fallout of reduced purchasing power is that consumers demand fewer goods and services. Typically, non-essential demands such as a vacation get curtailed while households focus on the essentials.

* It harms savers and helps borrowers. High inflation eats away the real interest earned from keeping one’s money in the bank or similar savings instruments. Earning a 6% nominal interest from a savings deposit effectively means earning no interest if inflation is at 6%. By the reverse logic, borrowers are better off when inflation rises because they end up paying a lower “real” interest rate.

* It helps the government meet debt obligations. In the short term, the government, which is the single largest borrower in the economy, benefits from high inflation. Inflation also allows the government to meet its fiscal deficit targets. Fiscal deficit limits are is expressed as a percentage of the nominal GDP. As the nominal GDP rises because of inflation (without necessarily implying an increase in overall production), the same amount of fiscal deficit (borrowing) become a smaller percentage of the GDP.

* Mixed results for corporate profitability. In the short term, corporates, especially the large and dominant ones, could enjoy higher profitability because they might be in a position to pass on the prices to consumers. But for many companies, especially smaller ones, persistently higher inflation will reduce sales and profitability because of lower demand.

* It worsens the exchange rate. High inflation means the rupee is losing its power and, if the RBI doesn’t raise interest rates fast enough, investors will increasingly stay away because of reduced returns. For instance, as of Thursday, the return on a 10-year Government of India bond, which is essentially a risk-free investment, was 7.2%. But with inflation at 7.8%, this implies a negative rate of return.

* It leads to expectations of higher inflation. Persistently high inflation changes the psychology of people. People expect future prices to be higher and demand higher wages. But this, in turn, creates its own spiral of inflation as companies try to price goods and services even higher.

The way out is for the RBI to raise interest rates in a credible fashion. The difficulty is that raising interest rates at the current juncture, when growth is iffy, could lead to concerns of stagflation.

Newsletter | Click to get the day’s best explainers in your inbox

[ad_2]

Source link