Biden Planning to Tap Oil Reserve to Control Gas Prices

[ad_1]

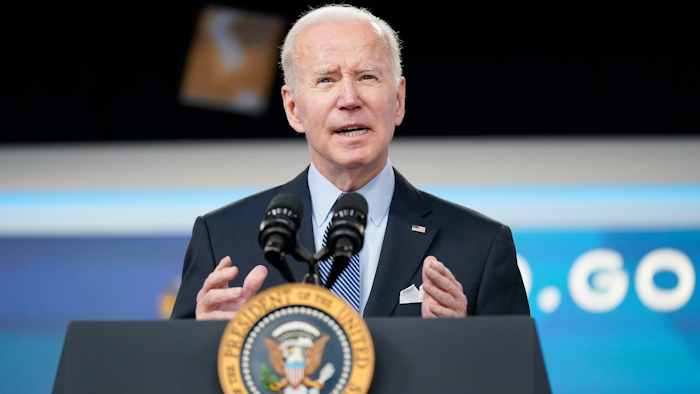

President Joe Biden speaks about status of the country’s fight against COVID-19 in the South Court Auditorium on the White House campus, Wednesday, March 30, 2022, in Washington.

AP Photo/Patrick Semansky

WASHINGTON (AP) — President Joe Biden is preparing to order the release of up to 1 million barrels of oil per day from the nation’s strategic petroleum reserve, according to two people familiar with the decision, in a bid to control energy prices that have spiked as the U.S. and allies have imposed steep sanctions on Russia over its invasion of Ukraine.

The announcement is expected Thursday when Biden delivers remarks on his administration’s plans to combat rising gas prices. The duration of the release hasn’t been finalized but could last for several months. The people spoke on the condition of anonymity to preview the decision.

The expected move by Biden shows that oil remains a key vulnerability for the U.S. at home and abroad. Higher prices have crushed Biden’s approval domestically, while also adding billions of dollars to the Russian war chest as it wages war on Ukraine. The release of reserves would create pressures that could reduce oil prices, though Biden has already twice ordered releases from the strategic reserves without causing a meaningful shift in oil markets.

Part of Biden’s conundrum is that high prices have not coaxed a meaningful jump in oil production. The planned release is a way to increase supplies. The markets reacted quickly with crude oil prices dropping more than 3% on Thursday morning to roughly $104 a barrel. Still, oil is up from roughly $60 a year ago as supplies have not kept up with demand as the world economy began to rebound from the coronavirus pandemic.

Americans on average use about 21 million barrels of oil daily, with about 40% of the consumption devoted to gasoline, according to the U.S. Energy Information Administration.

Domestic oil production is equal to more than half of the country’s usage, but high prices have not led companies to return to their pre-pandemic levels of output. The U.S. is producing on average 11.7 million barrels daily, down from 13 million barrels in early 2020.

Republican lawmakers have said the problem rests with the Biden administration being hostile to oil permits and the construction of new pipelines such as the Keystone XL. Democrats have countered that the country needs to move to renewable energy such as wind and solar that could reduce the dependence on fossil fuels and Russia President Vladimir Putin’s leverage.

“I think the administration’s anti-fossil fuel views are sort of like a religion,” Senate Republican Leader Mitch McConnell told Punchbowl News in a Thursday interview. “They’re kind of unconnected with the needs of not only our country but the world. This policy is driven by the hard left, which the president almost never crosses. And, until that policy changes, we’re gonna have a problem.”

Oil producers have been more focused on meeting the needs of investors than consumers, according to a survey released last week by the Dallas Federal Reserve. About 59% of the executives surveyed said investor pressure to preserve “capital discipline” amid high prices was the reason they weren’t pumping more, while fewer than 10% blamed government regulation.

The steady release from the reserves would be a meaningful sum and come near to closing the domestic production gap relative to February 2020, before the coronavirus caused a steep decline in oil output.

The Biden administration in November announced the release of 50 million barrels from the strategic reserve in coordination with other countries. And after the Russia-Ukraine war began, the U.S. and 30 other countries agreed to an additional release of 60 million barrels from reserves, with half of the total coming from the U.S.

According to the Department of Energy, which manages it, more than 568 million barrels of oil were held in the reserve as of March 25.

News of the administration’s planning was first reported by Bloomberg.

[ad_2]

Source link