Anil Ambani’s Reliance Group and multiple investigations by ED

This is a major corporate and legal development in India. The case involves Anil Ambani’s Reliance Group and multiple investigations by the Enforcement Directorate (ED) and the Central Bureau of Investigation (CBI) under the Prevention of Money Laundering Act (PMLA).

Here is a summary of the key details and allegations:

🚨 Major Regulatory Action and Status

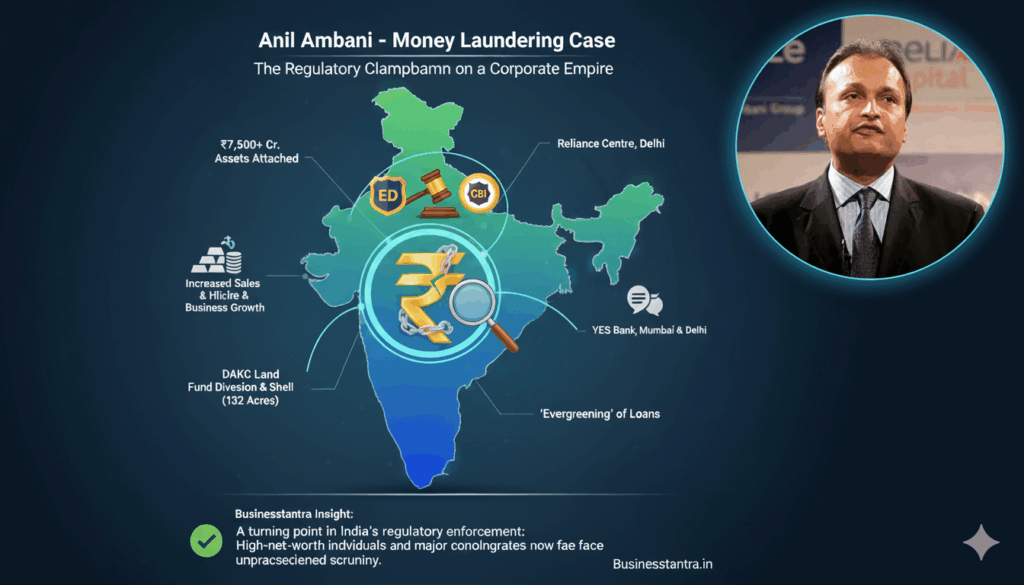

- Asset Attachment: The ED has issued provisional attachment orders under PMLA, attaching assets worth over ₹7,500 crore linked to Anil Ambani and his group entities.

- Key Assets Attached: These properties include his family residence in Pali Hill, Mumbai, the Reliance Centre in Delhi, and a massive 132-acre land parcel within the Dhirubhai Ambani Knowledge City (DAKC) in Navi Mumbai.

- Legal Basis: The action stems from multiple loan fraud cases involving group companies like Reliance Home Finance Ltd (RHFL), Reliance Commercial Finance Ltd (RCFL), and Reliance Communications Ltd (RCOM).

💰 Key Allegations

The core of the money laundering probe involves the alleged fraudulent diversion and layering of public funds, primarily loans and investments from banks (including Yes Bank and others).

- Yes Bank Link: Between 2017 and 2019, Yes Bank invested in RHFL and RCFL instruments, which later turned into Non-Performing Assets (NPAs), causing significant losses to the bank.

- Fund Diversion: Allegations state that funds were siphoned off and routed through a web of shell companies and affiliated entities within the Reliance Anil Ambani Group (RAAG) ecosystem.

- ‘Evergreening’ of Loans: Funds were allegedly diverted to keep existing loans appearing active or to repay other debts, contravening the terms and conditions of the loan sanctions.

- Procedural Lapses: The ED noted serious control failures, including:

- Loans being sanctioned to uncreditworthy or barely operational borrowers.

- Same-day sanction and disbursal of loans.

- Inadequate or missing security/collateral for loans.

- PMLA Focus: The ED’s primary goal is to trace the proceeds of the alleged crime (the “tainted money”) and secure attachments of these properties to eventually restore the losses to the public and victim banks.

🔍 Insight by Businesstantra

When a corporate empire as big as RAAG is drawn into a PMLA attachment case, the ripple effect goes beyond balance sheets. What we are witnessing is a turning point in India’s regulatory-enforcement regime — where high-net-worth individuals and major conglomerates face the same scrutiny that once seemed reserved only for smaller players.

Cash flows, loan practices, and asset structures are increasingly transparent — and the era of impunity is fading. For business leaders and entrepreneurs, this is a clear lesson: compliance, clarity, and ethical financial practices are no longer optional extras — they are foundational to sustainability.